#Closed loop insulin system

Explore tagged Tumblr posts

Text

So I saw this post the other day (and maybe because I've been diabetic a quarter of a century but "diabetes monitor" usually means this in my mind, not a sensor)

But anyways! Ink and T1D!Reader are friends with Sci who could definitely design a closed loop system for Ink! (For non diabetics, a closed loop system is a sensor and insulin pump that "talk to each other" to constantly dose and adjust in the background, allowing for better control and less frequent doses of insulin and less lows and yes I'm a Dexcom and Omnipod girlie)

13 notes

·

View notes

Text

T1D Technology

Growing up with emerging technology is definitely a unique experience for everyone in their own way. Personally for me, my relationship with technology is a little different because of my disability as a type 1 diabetic. This is an adolescent, autoimmune, and permanent disease that stops the production of insulin in the body that destabilizes the control of blood sugar. The way I rely on technology is interestingly different from your average person due to the technological advances made in the recent years. I’m now able to give myself insulin and know my blood sugar levels through my phone that's connected to the devices attached to me. I am quite literally attached to technology 24/7. When I was younger this did not exist and instead I was poking and injecting myself with needles over 10x a day. It's scary to rely on technology like this because if for whatever reason the internet goes down or the apocalypse happens, how am I going to be safe and carry on? Technology like this sometimes doesn't always live up to the expectations, for example a recent new advancement has been something called the closed loop system which works with your insulin pump and your blood sugar monitor machine to work as one. So if your blood sugar goes up then the machine will automatically give you insulin to bring the glucose down. Sounds really nice, but a large flaw in this design was the over application of insulin. As T1D’s our blood sugar is affected by everything we do, physically, emotionally, and mentally and this new advancement doesn't always take that into consideration and creates a new problem. For example, exercise for me tends to lower my blood sugar. If I’m riding high blood sugars and I’m working out, but the new closed loop system doesn't know this and still gives me more insulin, I'm going to be dealing with extremely dangerous low glucose. I’ve been managing my body like this for over a decade since I was 10 years old, so It feels weird allowing this machine to do the work for me when I know my body and how it reacts better than anyone or any machine. Don't get me wrong, I'm so thankful for the access to medicine and technology today that those in the past never got to live to experience. But there are always flaws and issues with technology like this that do not consider all other outside factors. We should use, adapt and understand technology but we should also remind ourselves how to live when we don't have this type of access anymore.

2 notes

·

View notes

Text

Hmm, ok. I think it's finally time to accept that I have to stay peanut free. Any format. They need to go.

Anyhoo....Not gonna cry about it. It is what it is.

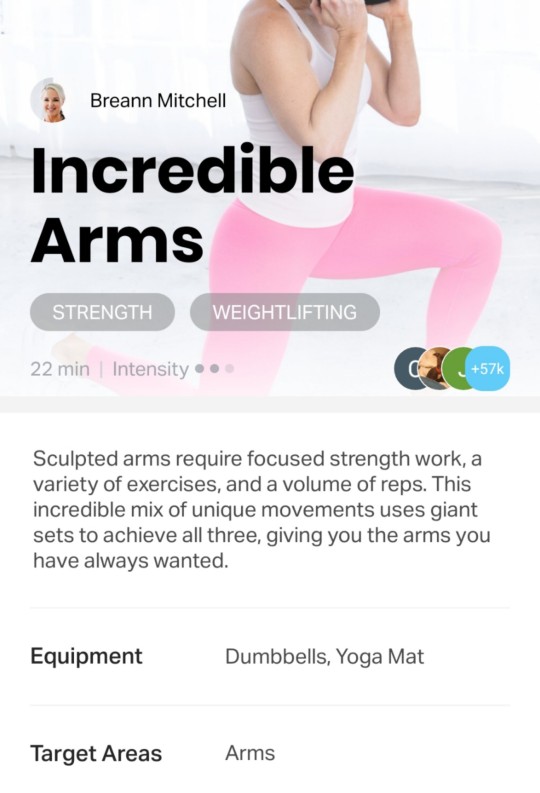

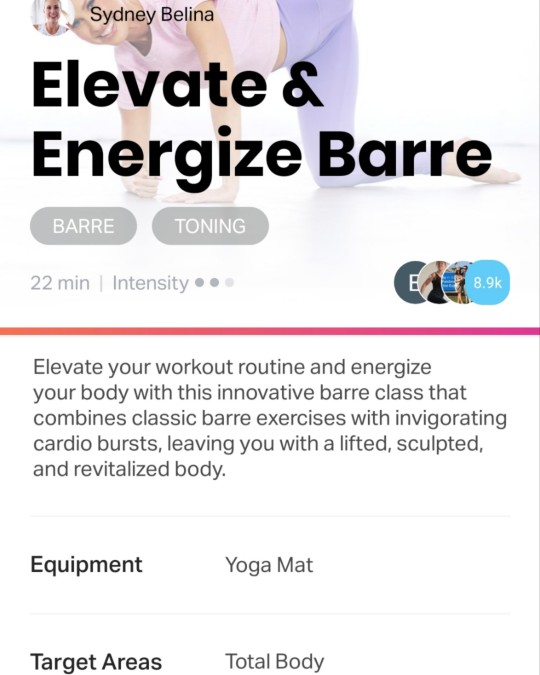

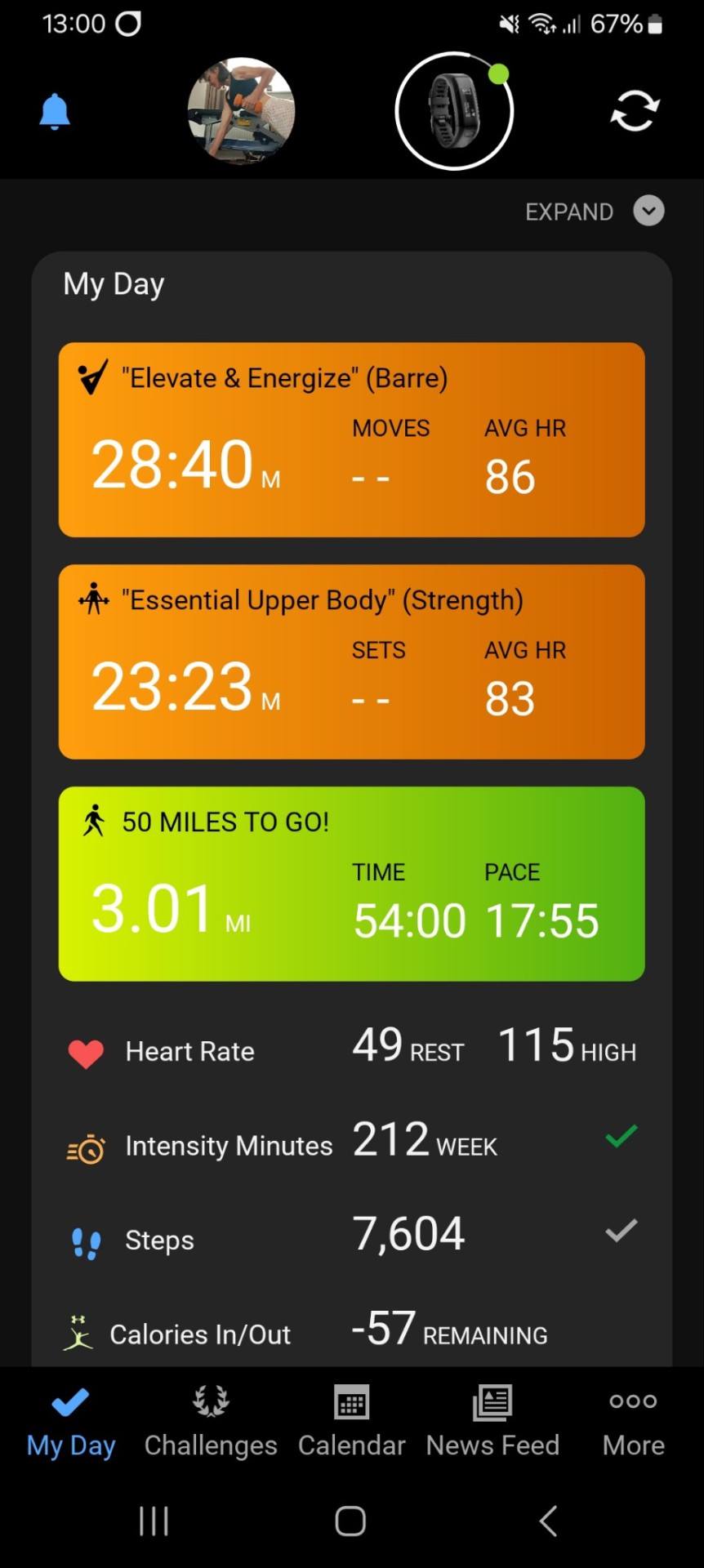

A very steady day. One walk and two short, medium effort home workouts.

Upper body strength after my walk. Then full body barre before lunch.

I was going to do something later, but the motivation wasn't there, for a few different reasons.

Still waiting for my omnipod/dexcom insulin pump loop system to settle down. No progress whatsoever, it seems.

That is definitely impacting both my physical and mental energy. Not exactly helping my emotional energy either.

But I keep tiptoeing through. I won't accept any other choice.

I've stuck pretty close to my macro targets, even with an extra (totally emotionally driven) snack. Mixed nuts (the ones I'm ok with), olive oil spray and sea salt. That's now my regular breakfast from tomorrow, unless i think of something else. That extra snack obviously wasn't my breakfast, lol!

The pic is from those final peanuts this morning.

I've got to put myself back into "take each day as it comes" mode.

Other "life stuff" going on right now, too. So I'm having to acknowledge this isn't a time to push.

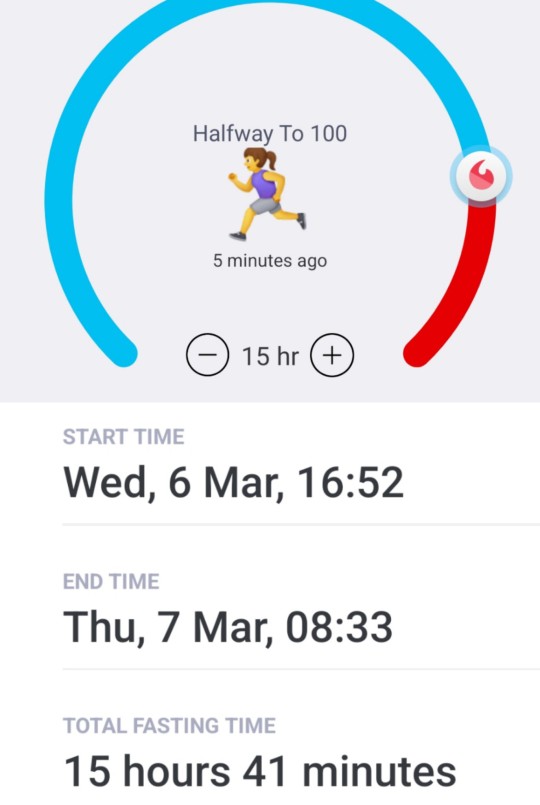

I'm really glad I'm halfway through my 100 mile challenge to support the MIND mental health charity.

I'm seriously lacking donations, which saddens me, but I'm looking at it as a personal achievement interest, and the knowledge that I'm doing what I can to help out and show support for an excellent cause. I've also donated money myself.

Let's see what tomorrow brings....

#fitspo#fitspiration#fitblr#fitness#healthy living#health and fitness#fit#workout#fiton#suzieb-fit#mental health#mental illness#health and nutrition#diet and nutrition#healthy nutrition#dietary restrictions#allergens#allergic reaction#type one diabetic#type 1 diabetic#type 1 diabetes

11 notes

·

View notes

Text

Diabetes Devices Market Growth: The Hidden Forces Driving Demand

Diabetes Devices Market Overview: Precision Tools Driving a Diabetes Care Revolution

The global diabetes devices market is undergoing a profound transformation, fueled by groundbreaking innovations in glucose monitoring, insulin delivery systems, and integrated management platforms. From 2024 to 2031, the diabetes devices market is projected to expand at a robust CAGR of 7.45%, reflecting rising diabetes prevalence, technological progress, and a paradigm shift toward patient-centered chronic disease management.

Diabetes technologies are no longer limited to mere tools for blood sugar testing—they have evolved into intelligent systems that enhance real-time decision-making and clinical outcomes.

Request Sample Report PDF (including TOC, Graphs & Tables): https://www.statsandresearch.com/request-sample/40486-global-diabetes-devices-market

Advanced Blood Glucose Monitoring Devices: Real-Time Insights for Optimal Control

Self-Monitoring Blood Glucose (SMBG)

SMBG devices remain foundational for day-to-day blood glucose management. These compact, portable glucometers empower patients with immediate feedback, helping them fine-tune lifestyle and medication adherence.

Key benefits:

Instant readings from small blood samples

Increased patient autonomy

Portability for routine and emergency checks

Continuous Glucose Monitoring (CGM) Systems

CGMs deliver continuous, real-time glucose readings and trend data. Equipped with sensors, transmitters, and receivers, CGMs reduce the need for fingersticks and provide predictive alerts for hypo- or hyperglycemia.

Key CGM advancements:

14+ day sensor wear

Bluetooth-enabled smartphone synchronization

AI-based analytics for glucose forecasting

HbA1c Testing Devices

HbA1c kits quantify average glucose control over 2–3 months:

Point-of-care devices for rapid, on-site diagnostics

Laboratory systems for comprehensive accuracy

HbA1c remains a clinical gold standard for evaluating therapy efficacy and long-term risk mitigation.

Get up to 30%-40% Discount: https://www.statsandresearch.com/check-discount/40486-global-diabetes-devices-market

Intelligent Insulin Delivery Systems: Automation Meets Accuracy

Insulin Pens

Favored for their precision and ease of use, insulin pens now feature:

Dose memory logs

App connectivity

Pre-filled cartridges to reduce waste

Insulin Pumps

Pumps offer continuous subcutaneous insulin infusion (CSII) and can be fine-tuned based on CGM data:

Basal-bolus automation

Meal-time dosing adjustments

Wearable, discreet form factors

Jet Injectors and Syringes

Jet injectors provide needle-free delivery via high-pressure microstreams, enhancing comfort and compliance. Conventional syringes, although less technologically advanced, remain cost-effective and widely used in certain demographics.

Artificial Pancreas Systems: The Apex of Closed-Loop Innovation

Artificial pancreas systems represent a pinnacle in diabetes tech, seamlessly integrating CGM data with insulin pumps to deliver fully automated insulin dosing. These systems minimize glycemic variability and improve time-in-range metrics.

Key Features:

Real-time glucose sensing

Algorithm-driven insulin titration

Auto-correction boluses

They herald a future of "hands-off" diabetes management, dramatically reducing patient burden.

Technology-Based Segmentation: The Age of Wearables, Non-Invasive, and Implantable Solutions

Wearable Devices

Wearables dominate the CGM and pump sectors. These smart devices improve user experience by integrating with:

Mobile apps

Smartwatches

Cloud-based physician dashboards

Non-Invasive Technologies

Emerging innovations eliminate blood draws, using:

Sweat, interstitial fluid, or optical signals for glucose detection

Painless insulin administration via transdermal patches or microneedles

Implantables

Implantable sensors, like Eversense, offer 180-day wear periods and minimal maintenance. Future prospects include fully implantable insulin pumps, aiming to redefine long-term diabetes care.

Strategic Distribution Channels: Multi-Access Approaches to Device Availability

Hospital Pharmacies

Institutional procurement hubs providing inpatient access to:

Advanced CGMs

Emergency-use insulin delivery systems

Diagnostic kits

Retail Pharmacies

Community-focused outlets that offer:

Immediate patient counseling

High-availability insulin pens and meters

Support for device onboarding

Online Pharmacies

Digital-first platforms providing:

Subscription-based sensor replacements

Remote device calibration

Rapid delivery of critical supplies

Diabetes Clinics and Home Care

Specialized care centers and in-home setups enable:

Personalized device configurations

Telehealth integration

Longitudinal glucose trend analysis for home-managed patients

Regional Diabetes Devices Market Insights: Diverse Demand Across Geographies

North America

U.S. leads the global market with deep penetration of CGMs and artificial pancreas systems

Strong presence of key players such as Dexcom, Medtronic, Insulet

Europe

High adoption of insulin pumps in Germany, UK, and France

Expanding reimbursement frameworks fostering CGM use

Asia-Pacific

Explosive growth in China, India, Japan, driven by rising diabetes incidence

Government subsidies and healthtech startups catalyze device access

Middle East, Africa, and South America

Improving healthcare infrastructure

Strategic partnerships with global manufacturers expanding regional footprints

Leading Companies Transforming the Diabetes Devices Market

Medtronic plc – Leader in closed-loop insulin delivery systems

Dexcom Inc. – Pioneer in CGM technology and real-time data integration

Abbott Laboratories – Innovator of sensor-based FreeStyle Libre systems

Insulet Corporation – Renowned for tubeless insulin pump design (Omnipod)

Novo Nordisk A/S – Dominant in insulin pens and injectors

Ypsomed Holding – Developer of user-friendly pen platforms and mobile apps

Arkray Inc. – Key manufacturer of SMBG devices for emerging markets

Projected Growth: 2024–2031 Forecast

The global diabetes devices market is projected to surpass prior milestones, reaching substantial valuation by 2031. Growth is underpinned by:

Technological breakthroughs in non-invasive monitoring

Rising global awareness and screening programs

Increasing demand for real-time digital health solutions

Purchase Exclusive Report: https://www.statsandresearch.com/enquire-before/40486-global-diabetes-devices-market

Conclusion

The global diabetes devices market is advancing toward a future where data-driven automation, patient empowerment, and seamless integration define chronic disease management. As demand escalates across regions and demographics, companies that prioritize innovation, usability, and personalization will lead the next chapter in diabetic care. With sophisticated tools becoming more accessible and user-friendly, we are witnessing a technological renaissance poised to transform the lives of millions worldwide.

Our Services:

On-Demand Reports: https://www.statsandresearch.com/on-demand-reports

Subscription Plans: https://www.statsandresearch.com/subscription-plans

Consulting Services: https://www.statsandresearch.com/consulting-services

ESG Solutions: https://www.statsandresearch.com/esg-solutions

Contact Us:

Stats and Research

Email: [email protected]

Phone: +91 8530698844

Website: https://www.statsandresearch.com

1 note

·

View note

Text

Poor diabetes control: Latest technology may have a solution

Type 2 diabetes constitutes around 90% of diabetes in the world. While we do not have any control over Type 1 diabetes, Type 2 diabetes is mostly caused due to lifestyle factors such as poor diet, low physical activity, high BMI, and environmental hazards. Most of these factors can be eliminated by proper monitoring and discipline. And that is how nowadays health experts talk about diabetes reversal or putting diabetes into remission.

Apart from medications and introducing lifestyle changes like a proper nutrient-rich diet and daily physical activity, health care experts nowadays also take the help of the latest technology to keep poorly managed diabetes in control. The aim of current research and innovation in the field of diabetes is to enhance management as well as treatment so that a potential cure for the disease is discovered.

Implantable devices

One of the latest technological aids that have helped in the management of diabetes is wearable and implantable devices. These devices help track insulin release and have emerged as one of the most helpful advancements in the management of diabetes. The wearable devices are convenient and ensure the right tracking of blood sugar levels thereby helping the patient improve his diabetic condition.

Insulin pump

Insulin pumps are small devices that keep on delivering insulin supply rapidly and continuously with the help of a catheter that is placed under the patient’s skin. This particular pump is so designed that it keeps on administering the precise dosage of insulin all through the day the way a healthy pancreas naturally delivers insulin into the body.

A few products in this category also come with additional features such as continuous glucose monitoring (CGM) that keeps on providing real-time data related to the levels of blood sugar in the body.

Closed-loop insulin delivery system

The latest technology-aided implantable devices like closed-loop insulin systems automate insulin delivery as per the glucose levels. Such devices have an assembly of small machines like a CGM sensor, a control algorithm that monitors blood sugar levels and accordingly delivers insulin and an insulin pump.

Some of these devices have such a high level of technology that the algorithms in them also predict future blood sugar levels by analysing past and present trends and patterns and accordingly offer personalised suggestions for adjusting insulin dosage or even the dosage of lifestyle medications.

2 notes

·

View notes

Text

Competitive Landscape of the Continuous Glucose Monitoring Market

Unlocking the Future of Diabetes Care: CGM Market Growth and Innovation Insights

According to the latest publication from Meticulous Research®, the continuous glucose monitoring market is projected to reach $31.41 billion by 2032, at a CAGR of 15% during the forecast period 2025–2032. The growth of this market is driven by factors such as the increasing prevalence of diabetes and the number of people living a sedentary lifestyle, the benefits of continuous glucose monitoring over conventional glucose monitoring, and the use of CGM by athletes and fitness enthusiasts. Furthermore, technological advancements in CGM devices, a shift towards personalized care, rising health awareness, and increasing accessibility for diabetes care devices in low and middle-income countries are expected to offer growth opportunities in the market.

The global diabetes care industry is undergoing a transformation, led by rapid technological advancements in continuous glucose monitoring (CGM) systems. These wearable devices have evolved from basic tracking tools into real-time health platforms that are reshaping disease management, lifestyle interventions, and personalized care. Key factors influencing this change include breakthroughs in sensor accuracy, regulatory landscape challenges, rising healthcare investments across Asia-Pacific, insulin pump integrations, and global trends like increasing obesity.

Technological Advancements Driving Accuracy in CGM Devices

Modern CGM systems leverage cutting-edge sensor technology to deliver more accurate and reliable glucose readings. Innovations such as enzyme-free biosensors, nanotechnology-enhanced electrodes, and real-time data analytics allow these devices to detect glucose levels with higher precision. For instance, some systems now use optical detection or continuous interstitial fluid analysis, significantly reducing calibration needs and signal drift. These improvements not only enhance user confidence but also enable their integration with automated insulin delivery systems—advancing the goal of a fully closed-loop artificial pancreas.

This trend reflects the broader movement toward smarter, more responsive CGM tools that can adapt to patient behavior, physiological variability, and external factors such as temperature or activity level. As accuracy increases, so does the potential for CGMs to be used beyond diabetes—such as in weight management or performance optimization.

Navigating the Regulatory Terrain

Despite the promise, CGM device manufacturers face substantial regulatory scrutiny. Agencies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) require extensive clinical validation, safety assessments, and cybersecurity assurances for these devices. With many CGMs now integrated with insulin pumps or digital platforms, they are often classified as Class II or Class III medical devices—necessitating longer approval timelines and strict post-market surveillance.

Global harmonization is another challenge. Different regions have varying requirements for labeling, user training, and interoperability, creating a complex compliance environment. Moreover, concerns about data privacy and security—particularly with real-time cloud syncing—further heighten the regulatory burden.

Asia-Pacific: A Rising Power in CGM Market Expansion

The Asia-Pacific region is emerging as a high-growth hub for CGM adoption, driven by escalating diabetes prevalence, rising obesity, urban lifestyle changes, and healthcare digitization. Increased public and private healthcare spending across China, India, Japan, and Southeast Asia is making advanced diabetes tools more accessible. As CGM prices decline and government reimbursement frameworks expand, the demand for real-time glucose monitoring is expected to accelerate.

This regional boom is further fueled by the aging population and growing awareness around chronic disease prevention. Home-based care and remote monitoring—essential in rural or underserved areas—are also gaining traction, helping CGMs become more deeply embedded in primary healthcare.

Smart Integration with Insulin Pumps

One of the most transformative advances in CGM use is its integration with insulin pumps. These systems allow for continuous monitoring and automated insulin delivery based on glucose trends, significantly reducing the frequency and severity of hyperglycemic and hypoglycemic episodes.

Hybrid closed-loop systems (also known as artificial pancreas systems) are already changing how insulin-dependent patients manage diabetes. They offer improved glycemic control, reduce manual interventions, and enable better “time-in-range” metrics. This integration is not only clinically beneficial but also enhances the daily lives of users, especially those with type 1 diabetes who require constant monitoring and insulin adjustments.

Obesity Trends Fueling CGM Adoption

The increasing global prevalence of obesity is another key driver of CGM market growth. Obesity is a major risk factor for type 2 diabetes, and early CGM use among at-risk individuals can enable preventive interventions. Furthermore, CGMs are now being marketed for wellness and weight management, even for people without diabetes. By offering real-time feedback on how food, sleep, and exercise affect glucose levels, CGMs are empowering people to make informed lifestyle choices.

This shift is creating a new consumer health segment for CGM manufacturers, with devices targeted not only at diabetics but also at individuals seeking metabolic health insights.

Market Overview and Industry Landscape

According to the Meticulous Research® report, the Continuous Glucose Monitoring (CGM) market is projected to reach USD 31.41 billion by 2032, growing at a CAGR of 15% from 2025 to 2032. The surge in demand is led by the home-care settings segment, which is expected to account for over 82.3% of the total CGM usage by 2025.

The CGM industry is powered by the contributions of major players such as DexCom, Inc., Abbott Laboratories, F. Hoffmann-La Roche Ltd., Medtronic plc, Nemaura Medical Inc., LifeScan Inc., Senseonics Holdings, Inc., A. Menarini Diagnostics S.r.l., Medtrum Technologies Inc., and B. Braun Melsungen AG. Together, these companies are at the forefront of innovation, driving accessibility, and expanding the global reach of CGM technology.

Conclusion

As CGM devices become more accurate, integrated, and user-friendly, their role in diabetes and overall metabolic health management is expanding rapidly. While regulatory and pricing challenges remain, growing awareness, rising healthcare investments in Asia-Pacific, and the global obesity epidemic are aligning to fuel widespread adoption. Backed by strong industry players, the CGM market is on a transformative path, reshaping the future of personalized health monitoring.

Download Sample Report Here @ https://www.meticulousresearch.com/download-sample-report/cp_id=5960

Contact Us: Meticulous Research® Email- [email protected] Contact Sales- +1-646-781-8004 Connect with us on LinkedIn- https://www.linkedin.com/company/meticulous-research

#ContinuousGlucoseMonitoring#CGMMarket#DiabetesManagement#GlucoseMonitoringDevices#WearableHealthTech#RealTimeMonitoring#BloodGlucoseTracking#MedicalDevicesMarket#HealthcareInnovation#DigitalHealthSolutions

0 notes

Text

Regional Insights into the Continuous Glucose Monitoring Market

Unlocking the Future of Diabetes Care: CGM Market Growth and Innovation Insights

According to the latest publication from Meticulous Research®, the continuous glucose monitoring market is projected to reach $31.41 billion by 2032, at a CAGR of 15% during the forecast period 2025–2032. The growth of this market is driven by factors such as the increasing prevalence of diabetes and the number of people living a sedentary lifestyle, the benefits of continuous glucose monitoring over conventional glucose monitoring, and the use of CGM by athletes and fitness enthusiasts. Furthermore, technological advancements in CGM devices, a shift towards personalized care, rising health awareness, and increasing accessibility for diabetes care devices in low and middle-income countries are expected to offer growth opportunities in the market.

The global diabetes care industry is undergoing a transformation, led by rapid technological advancements in continuous glucose monitoring (CGM) systems. These wearable devices have evolved from basic tracking tools into real-time health platforms that are reshaping disease management, lifestyle interventions, and personalized care. Key factors influencing this change include breakthroughs in sensor accuracy, regulatory landscape challenges, rising healthcare investments across Asia-Pacific, insulin pump integrations, and global trends like increasing obesity.

Technological Advancements Driving Accuracy in CGM Devices

Modern CGM systems leverage cutting-edge sensor technology to deliver more accurate and reliable glucose readings. Innovations such as enzyme-free biosensors, nanotechnology-enhanced electrodes, and real-time data analytics allow these devices to detect glucose levels with higher precision. For instance, some systems now use optical detection or continuous interstitial fluid analysis, significantly reducing calibration needs and signal drift. These improvements not only enhance user confidence but also enable their integration with automated insulin delivery systems—advancing the goal of a fully closed-loop artificial pancreas.

This trend reflects the broader movement toward smarter, more responsive CGM tools that can adapt to patient behavior, physiological variability, and external factors such as temperature or activity level. As accuracy increases, so does the potential for CGMs to be used beyond diabetes—such as in weight management or performance optimization.

Navigating the Regulatory Terrain

Despite the promise, CGM device manufacturers face substantial regulatory scrutiny. Agencies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) require extensive clinical validation, safety assessments, and cybersecurity assurances for these devices. With many CGMs now integrated with insulin pumps or digital platforms, they are often classified as Class II or Class III medical devices—necessitating longer approval timelines and strict post-market surveillance.

Global harmonization is another challenge. Different regions have varying requirements for labeling, user training, and interoperability, creating a complex compliance environment. Moreover, concerns about data privacy and security—particularly with real-time cloud syncing—further heighten the regulatory burden.

Asia-Pacific: A Rising Power in CGM Market Expansion

The Asia-Pacific region is emerging as a high-growth hub for CGM adoption, driven by escalating diabetes prevalence, rising obesity, urban lifestyle changes, and healthcare digitization. Increased public and private healthcare spending across China, India, Japan, and Southeast Asia is making advanced diabetes tools more accessible. As CGM prices decline and government reimbursement frameworks expand, the demand for real-time glucose monitoring is expected to accelerate.

This regional boom is further fueled by the aging population and growing awareness around chronic disease prevention. Home-based care and remote monitoring—essential in rural or underserved areas—are also gaining traction, helping CGMs become more deeply embedded in primary healthcare.

Smart Integration with Insulin Pumps

One of the most transformative advances in CGM use is its integration with insulin pumps. These systems allow for continuous monitoring and automated insulin delivery based on glucose trends, significantly reducing the frequency and severity of hyperglycemic and hypoglycemic episodes.

Hybrid closed-loop systems (also known as artificial pancreas systems) are already changing how insulin-dependent patients manage diabetes. They offer improved glycemic control, reduce manual interventions, and enable better “time-in-range” metrics. This integration is not only clinically beneficial but also enhances the daily lives of users, especially those with type 1 diabetes who require constant monitoring and insulin adjustments.

Obesity Trends Fueling CGM Adoption

The increasing global prevalence of obesity is another key driver of CGM market growth. Obesity is a major risk factor for type 2 diabetes, and early CGM use among at-risk individuals can enable preventive interventions. Furthermore, CGMs are now being marketed for wellness and weight management, even for people without diabetes. By offering real-time feedback on how food, sleep, and exercise affect glucose levels, CGMs are empowering people to make informed lifestyle choices.

This shift is creating a new consumer health segment for CGM manufacturers, with devices targeted not only at diabetics but also at individuals seeking metabolic health insights.

Market Overview and Industry Landscape

According to the Meticulous Research® report, the Continuous Glucose Monitoring (CGM) market is projected to reach USD 31.41 billion by 2032, growing at a CAGR of 15% from 2025 to 2032. The surge in demand is led by the home-care settings segment, which is expected to account for over 82.3% of the total CGM usage by 2025.

The CGM industry is powered by the contributions of major players such as DexCom, Inc., Abbott Laboratories, F. Hoffmann-La Roche Ltd., Medtronic plc, Nemaura Medical Inc., LifeScan Inc., Senseonics Holdings, Inc., A. Menarini Diagnostics S.r.l., Medtrum Technologies Inc., and B. Braun Melsungen AG. Together, these companies are at the forefront of innovation, driving accessibility, and expanding the global reach of CGM technology.

Conclusion

As CGM devices become more accurate, integrated, and user-friendly, their role in diabetes and overall metabolic health management is expanding rapidly. While regulatory and pricing challenges remain, growing awareness, rising healthcare investments in Asia-Pacific, and the global obesity epidemic are aligning to fuel widespread adoption. Backed by strong industry players, the CGM market is on a transformative path, reshaping the future of personalized health monitoring.

Download Sample Report Here @ https://www.meticulousresearch.com/download-sample-report/cp_id=5960Contact Us: Meticulous Research® Email- [email protected] Contact Sales- +1-646-781-8004 Connect with us on LinkedIn- https://www.linkedin.com/company/meticulous-research

#ContinuousGlucoseMonitoring#CGMMarket#DiabetesManagement#GlucoseMonitoringDevices#WearableHealthTech#RealTimeMonitoring#BloodGlucoseTracking#MedicalDevicesMarket#HealthcareInnovation#DigitalHealthSolutions

0 notes

Text

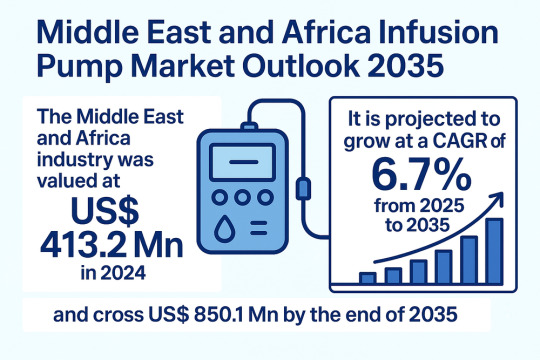

Middle East & Africa Infusion Pump Market Doubles by 2035

The Middle East and Africa (MEA) Infusion Pump Market, valued at US$ 413.2 million in 2024, is poised for significant growth over the next decade. According to recent market analysis, the sector is projected to expand at a CAGR of 6.7% from 2025 to 2035, reaching US$ 850.1 million by the end of the forecast period. The uptick in chronic diseases, technological innovations, and rising healthcare investments are accelerating the adoption of infusion therapy across hospitals and home-care settings throughout the region.

Infusion pumps are advanced medical devices used to deliver fluids such as medications, nutrients, and saline solutions into a patient’s body in a controlled and precise manner. These devices are indispensable in managing diseases like diabetes, cancer, chronic pain, and in providing post-operative care. With expanding use across hospitals, ambulatory centers, and increasingly in home-care settings, infusion pumps are enabling more flexible and effective treatment strategies for chronic and acute conditions alike.

Market Overview: The infusion pump market in the MEA region is currently experiencing moderate growth momentum, bolstered by an increasing disease burden, particularly from diabetes and cancer. Improvements in healthcare infrastructure in countries like Saudi Arabia, the UAE, South Africa, and Egypt, as well as a rising shift toward digital health solutions, are creating fertile ground for the uptake of smart and portable infusion systems. However, limited access to healthcare in rural areas and shortage of skilled personnel still pose challenges.

Market Drivers & Trends

1. Technological Advancements in Infusion Pump Systems

Modern infusion systems are increasingly becoming smarter and more efficient. From closed-loop systems that automatically adjust dosages to wireless connectivity with EHR systems, infusion technologies are helping enhance accuracy, safety, and workflow efficiency in hospitals and clinics. These advancements are driving adoption in critical areas such as oncology, ICU care, and diabetes management.

2. Surge in Demand for Precise Fluid Administration

The growing complexity of medical treatments and the increasing emphasis on patient safety are elevating the demand for precision in drug and fluid delivery. Infusion pumps significantly reduce human error by ensuring exact dosage and timing, which is vital for chemotherapy, parenteral nutrition, immunotherapy, and neonatal care.

3. Rise in Home-based Infusion Therapy

Portable and ambulatory infusion pumps are paving the way for home-based treatments, offering patients flexibility and comfort, especially those undergoing long-term care for chronic diseases. This trend is gaining traction across the region as health systems move toward cost-effective and patient-centered care models.

Analysis of Key Players

The MEA infusion pump market is highly competitive, with companies focusing on innovation, affordability, and strategic partnerships to strengthen market presence. Leading players include:

B. Braun Melsungen AG

Becton, Dickinson and Company (BD)

Medtronic plc

Baxter International Inc.

Fresenius Kabi AG

ICU Medical Inc.

Terumo Medical Corporation

NIPRO Medical Corporation

Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

Moog Inc.

These firms are prioritizing the development of AI-enabled, wireless, and eco-friendly infusion systems to meet both clinical needs and sustainability goals.

Recent Developments

In November 2024, Becton, Dickinson and Company (BD) partnered with the Infusion Nurses Society (INS) to promote standardized infusion practices across MENAT hospitals, aiming to elevate patient safety and improve clinical outcomes.

In February 2023, EOFlow Co., Ltd., in collaboration with UAE-based GulfDrug LLC, launched the EOPatch, a wearable, tubeless insulin pump in the Emirates. The EOPatch enables patients to benefit from discrete, continuous insulin delivery, reflecting the growing demand for personalized and mobile care technologies.

Download now to explore primary insights from our Report in this sample

Opportunities and Challenges

Opportunities:

Government initiatives to improve healthcare systems across the region.

Increased investments in local manufacturing, reducing dependency on imports.

Demand for smart, portable infusion pumps in home-care and ambulatory settings.

Rise in telemedicine and remote patient monitoring fueling need for integrated drug delivery systems.

Challenges:

Limited healthcare access in rural and remote regions.

Shortage of trained healthcare professionals to operate and maintain infusion devices.

Budget constraints in lower-income countries delaying adoption of advanced systems.

Market Segmentation

By Product Type:

Volumetric Pumps

Insulin Pumps

Syringe Pumps

PCA Pumps

Enteral Pumps

Elastomeric Pumps

Implantable Pumps

Accessories

By Route of Administration:

Intravenous

Subcutaneous

Intramuscular

Others

By Application:

Oncology

Gastroenterology

Pain Management

Diabetes

Immunology

Cardiology

Pediatrics and Neonatology

Others

By Therapy Type:

Chemotherapy

Parenteral and Enteral Nutrition

Antibiotics

Biologics

Pain Medication

Fluids

Others

By End-user:

Hospitals

Ambulatory Surgery Centers

Long-term Care Centers

Specialty Clinics

Home-care Settings

Others

Why Buy This Report?

In-depth Analysis: Understand key market dynamics, growth drivers, restraints, and emerging opportunities.

Strategic Insights: Identify winning strategies of leading players through competitive benchmarking.

Actionable Forecasts: Use reliable quantitative data for strategic decision-making.

Regional Intelligence: Evaluate high-potential markets within the MEA region.

Technology Landscape: Stay ahead with updates on smart, digital, and AI-powered infusion devices.

Explore Latest Research Reports by Transparency Market Research: Laryngeal Implants Market: https://www.transparencymarketresearch.com/laryngeal-implants-market.html

Continuous Monitoring Products in Healthcare Industry Market: https://www.transparencymarketresearch.com/continuous-monitoring-products-in-healthcare-industry-market.html

Spasticity Market: https://www.transparencymarketresearch.com/spasticity-market.html

Cancer Diagnostics Market: https://www.transparencymarketresearch.com/cancer-diagnostics-market.html About Transparency Market Research Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information. Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports. Contact: Transparency Market Research Inc. CORPORATE HEADQUARTER DOWNTOWN, 1000 N. West Street, Suite 1200, Wilmington, Delaware 19801 USA Tel: +1-518-618-1030 USA - Canada Toll Free: 866-552-3453 Website: https://www.transparencymarketresearch.com Email: [email protected]

0 notes

Text

Sugar Specialist Doctor In Gurgaon,

Gurgaon is experiencing a tsunami of diabetes, with 27.1% of adults diabetic or prediabetic, a 2023 Fortis Hospital study revealed - almost twice the national average. Amidst this crisis is Dr. Dr. Mudit Sabharwal, Gurgaon's premier diabetes expert, with 18 years of specialized practice and the latest technology in bringing proven results to the table:

✔ 9,000+ patients with 90% success rate in HbA1c reduction ✔ 2.1 point average reduction in HbA1c in 6 months (2023 data from clinic) ✔ 40-60% insulin requirement reduction through precision care

This in-depth guide discusses how his evidence-based treatment is successful where conventional diabetes care is not.

1. The Gurgaon Diabetes Crisis: Alarming Statistics Current Landscape 1 out of every 4 working professionals has undiagnosed prediabetes (Medanta Hospital Screening 2023)

35% greater prevalence in Gurgaon compared to Delhi NCR average (AIIMS Urban Health Study)

72% of patients are diagnosed with diabetes only when complications arise

Economic Impact Corporate employees lose 18 workdays/year due to diabetes-related complications

Treatment costs ₹25,000-50,000 a year in uncontrolled cases

Expert Insight: "Gurgaon's sedentary life, high-stress jobs, and culture of processed food create a perfect storm for diabetes," says Dr. Mudit Sabharwal

2. What Makes a True Diabetes Specialist Stand Out? Standard Care vs Specialist Care Factor General Physician Diabetes Specialist HbA1c Reduction 0.5-1 point 1.5-2.5 points Medication Review Annually Every Quarter Tech Utilization Basic glucometer CGMP + AI analysis Complication Screening Reactive Proactive Dr. Mudit Sabharwal Credentials Triple certified in Endocrinology, Diabetology and Metabolic Medicine

Visiting Faculty at AIIMS for higher-end diabetes technologies

Published 23 papers in peer-reviewed journals

3. The 5-Pillar Diabetes Reversal Framework Pillar 1: Continuous Glucose Monitoring (CGM) 83% more effective than finger-prick tests (Diabetes Care Journal)

Detects concealed post-meal spikes in 68% of "controlled" patients

₹8,000/month cost (usually paid by corporate insurance)

Pillar 2: Insulin Resistance Testing Advanced HOMA-IR and adipokine panels

Captures prediabetes 3-5 years before traditional tests

*Case Study: 42-year-old executive lowered fasting glucose from 126 to 89 mg/dL in 12 weeks with targeted IR treatment.*

4. Innovative Treatments Now Available a) Intelligent Insulin Protocols 40% less insulin required with optimization of time-in-range

Hybrid closed-loop systems for Type 1 diabetes

b) Non-Invasive Technologies Eversense E3 CGM: 6-month implantable sensor

GlycoLeap AI: Forecasts glucose trends with 92% accuracy c) Advanced Medications GLP-1 RAs: Mean 1.8% HbA1c decrease + weight loss

SGLT2 Inhibitors: 32% risk reduction for heart failure

5. Nutrition Science for Diabetes Management The Gurgaon Diet Challenge 78% of patients underreport 40-60% carb intake

Trendy "healthy" foods spiking the glucose levels:

Granola (+72 mg/dL)

Fresh juices (+58 mg/dL)

Hidden carb "sugar-free" products

Personalized Meal Planning Glycemic Load Optimization of Indian meals

Continuous Glucose Monitoring-authenticated food lists

Corporate lunchbox revamps for corporate professionals

Pro Tip: Adding 1 tbsp vinegar to meals decreases post-meal spikes by 23% (Diabetes Care).

6. Workable Exercise Prescriptions Metabolic Principles of Exercise Post-lunch workout reduces glucose 19% lower than morning

10-minute walks after meals decrease spikes by 30%

Resistance training increases insulin sensitivity 3x that of cardio

Gurgaon-Specific Solutions Office chair exercise routine for working professionals

DLF CyberCity walking trails with ideal glucose effect

Home HIIT protocols taking only 15 minutes

7. Stress & Sleep Management Gurgaon Corporate Stress Impact 68% of patients develop dawn phenomenon due to cortisol

Every hour of sleep loss adds 15% insulin resistance

Science-Backed Solutions CGM-based timing of meditation

Sleep hygiene interventions demonstrating 22% improved glucose control

Breathing exercises that reduce fasting sugar by 18-22 mg/dL

8. Success Stories & Clinical Outcomes 2023 Patient Results Parameter\tBefore\tAfter (6 months) Average HbA1c\t8.9%\t6.8% Medication Use\t3.2 drugs\t1.4 drugs Weight\t89 kg\t78 kg Energy Levels\t3/10\t8/10 *"After 10 years of unsuccessful treatments, Dr. [Name] guided me to 6.0 HbA1c without insulin." - Priya M., 49 (MG Road)*

9. Insurance & Affordability Coverage Options Most CGMs reimbursed under corporate health plans

Preventive care packages starting at ₹15,000/year

EMI facilities for state-of-the-art treatments

Cost Comparison Uncontrolled diabetes: ₹4.2 lakhs/year (complications)

Specialist care: ₹1.8 lakhs/year (prevention)

10. How to Get Started Step 1: Comprehensive Evaluation 90-minute initial consultation

15+ specialized tests

Personalized roadmap

Step 2: Ongoing Care Fortnightly CGM discussions

WhatsApp guidance with doctor

Quarterly progress scans

Limited Availability: Taking on 15 new patients/month only

Conclusion: Take Control of Your Metabolic Health Diabetes reversal is no longer a theory with personalized technology-driven care. 80% of patients can reach: ✔ HbA1c below 7% ✔ Lower medication burden ✔ Lasting lifestyle change begins today.

Best Diabetes Doctor in Gurgaon

0 notes

Text

Diabetes Devices Market user adoption trends and healthcare transformation by 2032

The global diabetes devices market was valued at USD 20.92 billion in 2018 and is projected to reach USD 48.35 billion by 2032, reflecting a CAGR of 6.2% over the forecast period. In 2018, North America held the largest share of the market, accounting for 40.54% of the global revenue.

The global diabetes devices market is experiencing steady growth, driven by the rising prevalence of diabetes, increasing health awareness, and advancements in glucose monitoring and insulin delivery technologies. The market includes a wide range of devices, from traditional blood glucose meters to continuous glucose monitors and smart insulin pumps, designed to improve diabetes management and patient outcomes. Growing demand for user-friendly, minimally invasive, and connected devices is further supporting market expansion. With the healthcare industry focusing more on preventive care and personalized treatment, the Diabetes Devices Market is expected to continue its upward trajectory across both developed and emerging regions.

Tap here to continue reading: https://www.fortunebusinessinsights.com/industry-reports/diabetes-devices-market-100803

Market Segmentation

The Diabetes Devices Market is segmented by device type, end user, and technology. Device categories include glucose monitoring devices (such as blood glucose meters and continuous glucose monitors) and insulin delivery systems (including insulin pens, pumps, and smart delivery devices). In terms of technology, the Diabetes Devices Market encompasses both traditional disposable strips and advanced sensor-based technologies. End users in the Diabetes Devices Market span hospitals, homecare settings, and specialized diabetes clinics, ensuring wide accessibility and usage.

List Of Key Companies Covered:

Hoffmann-La Roche Ltd

Tandem Diabetes Care, Inc.

Braun Melsungen AG

Medtronic

BD

Novo Nordisk A/S

Abbott

Sanofi

Other players

Market Growth

The Diabetes Devices Market is experiencing robust growth driven by the increasing prevalence of diabetes worldwide and the growing adoption of continuous glucose monitoring systems. Expansion of self-monitoring blood glucose devices and integration of smart insulin delivery technologies are key factors fueling the Diabetes Devices Market. Moreover, innovations such as wearable patches and closed-loop insulin pumps are positioning the Diabetes Devices Market for sustained innovation and market expansion.

Market Restraining Factors

Despite its growth potential, the Diabetes Devices Market faces challenges such as high costs associated with advanced monitoring systems and insulin delivery devices. Fragmented reimbursement policies in various regions are limiting market penetration of novel technologies in the Diabetes Devices Market. Additionally, concerns about data privacy and the need for technical training are slowing adoption of digital and connected diabetes devices, potentially restraining the Diabetes Devices Market.

Regional Analysis

Regionally, North America leads the Diabetes Devices Market thanks to well-established healthcare infrastructure and high adoption rates of diabetes management technologies. Europe follows with growing demand for continuous glucose monitoring and regulated reimbursement for diabetes devices. The Asia–Pacific region is rapidly expanding in the Diabetes Devices Market, supported by rising diabetes prevalence, increasing healthcare access, and growing middle-class demand. Meanwhile, Latin America and the Middle East & Africa show gradual growth in the Diabetes Devices Market, driven by improving healthcare policies and expanding awareness initiatives.

Key Industry Developments:

May 2021 – Medtronic announced receiving European approval for two of its diabetes management devices. The first, InPen, is a connected insulin pen developed for individuals requiring multiple daily injections. The second, the Guardian 4 sensor, is designed for use as a standalone continuous glucose monitor or in combination with the InPen. Both devices have been CE marked, marking a significant step in expanding Medtronic’s diabetes care portfolio in Europe.

Contact Us:

Fortune Business Insights Pvt. Ltd.

9th Floor, Icon Tower, Baner,

Mahalunge Road, Baner, Pune - 411045,

Maharashtra, India.

Phone:

US :+1 833 909 2966 ( Toll Free ) UK : +44 808 502 0280 ( Toll Free ) APAC: +91 744 740 1245

Email: [email protected]

0 notes

Text

Diabetes Devices And Drugs Market is growing amid robust VC funding

Market size and Overview Robust venture capital inflows in 2025 are catalyzing next-gen insulin and sensor platforms across global pipelines. Early-year allocations exceeding USD 500 million have directed focus on hybrid closed-loop systems.

The Global Diabetes Devices And Drugs Market size is estimated to be valued at USD 191.66 Bn in 2025 and is expected to reach USD 373.49 Bn by 2032, exhibiting a compound annual growth rate (CAGR) of 10% from 2025 to 2032. - Our Diabetes Devices And Drugs Market Insights report highlights shifting Diabetes Devices And Drugs Market trends toward personalized therapies. - Global market size surges driven by CGM adoption and high-dose insulin analogs. - Insulin pump innovations have captured over 30% market share in established regions. - Rising market revenue from biosimilar insulins enhances market scope and enriches our market report. Get more insights on,Diabetes Devices And Drugs Market

#Coherent Market Insights#Diabetes Devices And Drugs#Diabetes Devices And Drugs Market#Diabetes Devices And Drugs Market Insights#Diagnosis and Monitoring

0 notes

Text

Middle East and Africa Infusion Pump Market Investment Opportunities

The Middle East and Africa (MEA) infusion pump market is witnessing sustained growth momentum, underpinned by a rising chronic disease burden, ongoing healthcare infrastructure development, and the growing preference for accurate and automated drug delivery systems. According to industry analysis, the market was valued at US$ 413.2 Mn in 2024 and is projected to reach US$ 850.1 Mn by 2035, growing at a compound annual growth rate (CAGR) of 6.7% from 2025 to 2035.

Chronic Diseases and Healthcare Expansion Fuel Market Growth

The MEA region is increasingly grappling with chronic diseases, particularly diabetes, cancer, and cardiovascular ailments, which require long-term and precise infusion therapies. With rising awareness about patient safety and medical accuracy, infusion pumps have become integral in hospital, outpatient, and homecare settings. Countries such as Saudi Arabia, UAE, South Africa, and Egypt are among those experiencing rapid demand growth, fueled by their high disease prevalence and improving access to healthcare.

Additionally, growing healthcare expenditure and public-private investments in digital transformation are helping overcome the traditional challenges of limited infrastructure and skilled personnel. The trend toward smart, portable, and wearable infusion devices is supporting the shift toward personalized and home-based care, a rising priority across the region.

Insulin Pumps Dominate Product Segmentation

Among all product types, insulin pumps lead the market share, driven by the staggering diabetes prevalence in the region. Countries like Saudi Arabia and the UAE rank among the highest globally for diabetes incidence. Insulin pumps, which allow continuous subcutaneous insulin infusion (CSII), offer an alternative to multiple daily injections, improving glycemic control and quality of life for patients.

Notably, in February 2023, EOFlow Co., Ltd. and its GCC partner Gulf Drug LLC launched the EOPatch, a tubeless, wearable insulin patch pump in the UAE. This aligns with the broader shift toward wearable, disposable technologies in infusion therapy.

Smart Infusion Technologies Drive Innovation

One of the defining trends in the MEA infusion pump market is the integration of intelligent features in infusion systems. Smart pumps with wireless connectivity, EHR integration, closed-loop feedback systems, and advanced software algorithms are increasingly adopted to enhance treatment safety and precision. These systems reduce medication errors and optimize dosing, especially for complex treatments such as chemotherapy and biologic infusions.

In November 2024, BD’s Middle East division partnered with the Infusion Nurses Society (INS) to improve infusion practices across MENAT (Middle East, North Africa, Turkey). The collaboration focuses on implementing standardized protocols to boost patient outcomes and healthcare quality.

Want to know more? Get in touch now. -https://www.transparencymarketresearch.com/contact-us.html

GCC Remains the Regional Leader

The Gulf Cooperation Council (GCC) region, led by Saudi Arabia, UAE, and Qatar, dominates the MEA infusion pump market. This leadership stems from:

High healthcare spending and strategic public investments

Rapid digitalization in healthcare delivery

Expanding prevalence of lifestyle diseases

Government incentives for medical device innovation and localization

The region’s focus on home-based care, supported by ambulatory and wearable devices, is enhancing the appeal of infusion therapy beyond hospital settings.

Key Market Restraints and Opportunities

Despite its growth, the market still faces challenges, including:

Limited access to advanced healthcare in rural and low-income regions

Lack of trained infusion care professionals

Budget constraints in public health systems

However, emerging opportunities are strong:

Localization of manufacturing to reduce costs and supply chain delays

Government reforms in countries like Egypt and South Africa aimed at improving healthcare access

Rising demand for home-based infusion therapy due to convenience and cost efficiency

Competitive Landscape

Major players active in the MEA infusion pump market include:

Braun Melsungen AG

Becton, Dickinson and Company

Medtronic plc

Baxter International Inc.

Fresenius Kabi AG

Terumo Medical Corporation

ICU Medical Inc.

NIPRO Medical Corporation

Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

Moog Inc.

These companies are focusing on sustainable production, AI-based infusion systems, and expansion into emerging economies to solidify their market position.

Segmentation Highlights

The market is segmented by product, administration route, application, therapy type, end-user, and geography:

Product Types: Volumetric, Syringe, Insulin, PCA, Enteral, Elastomeric, Implantable, Accessories

Routes of Administration: Intravenous, Subcutaneous, Intramuscular, Others

Applications: Oncology, Pain Management, Gastroenterology, Diabetes, Cardiology, Immunology, Pediatrics, Others

Therapy Types: Chemotherapy, Antibiotics, Fluids, Biologics, Enteral/Parenteral Nutrition, Pain Medication

End-users: Hospitals, Ambulatory Surgery Centers, Specialty Clinics, Long-term Care, Home-care Settings

Countries Covered: Turkey, GCC, Egypt, Tunisia, Morocco, Algeria, Pakistan, Israel, Iran

Outlook

With market size expected to double by 2035, and technological innovation reshaping patient care, the Middle East and Africa infusion pump market is on a trajectory of steady, transformative growth. Continued emphasis on accuracy, portability, and patient-centered solutions will define the next decade, positioning infusion technologies at the heart of chronic disease and acute care management in the region.

Explore our report to uncover in-depth insights -

0 notes

Text

Day two of following the recommendations in Mindy Pelz's "Menopause Reset" book.

Well, a couple of them for now.

Circadian rhythm helpers.

No caffeine for two hours, and sitting in the light of the rising sun.

Plus what I already do anyway, a morning workout.

Upper body strength. Always a preferred start to my day.

Back to normal life after a couple of iffy ones.

My diabetic appointment went well yesterday. My new consultant is actually wonderful. Love the guy! And not just because he's ok'd me to go on the "closed loop" treatment system.

That's where my CGM (glucose monitor) and insulin pump link up and take the thought and effort out of my background insulin delivery.

A game changer, hopefully.

It's potentially a long wait, but I'm in the queue. What a relief! And a weight off my poor, cortisol drained brain, lol.

Speaking of which, I'm booked in for a blood test in afew weeks to check several things including those cortisol levels.

But back to today. I'm going to make it a good one 😁

#fitspo#fitspiration#fitblr#fitness#healthy living#health and fitness#fit#workout#fiton#suzieb-fit#cortisol#hormonal imbalance#type one diabetic#type 1 diabetic#type 1 diabetes

19 notes

·

View notes

Text

Insulin Pump Market Size & Share, Growth Report 2025–2030

Insulin Pump Market Growth & Trends

According to a new report published by Grand View Research, Inc., the global insulin pump market is projected to reach a value of USD 9.66 billion by the year 2030, exhibiting a compound annual growth rate (CAGR) of 8.42% from 2025 to 2030. The growth of this market is being propelled primarily by ongoing technological advancements in medical devices and the increasing preference for insulin pumps over traditional insulin delivery methods such as multiple daily injections. These pumps offer a high level of convenience and improved lifestyle management for individuals who require frequent insulin administration.

An insulin pump is a compact medical device designed to deliver insulin into the body either manually or automatically, depending on the user’s needs and the system’s programming. These devices can be calibrated to dispense precise, scheduled doses of insulin and are also capable of delivering larger doses, particularly around mealtimes when blood glucose levels tend to rise. Moreover, many modern pumps are integrated with smartphone applications, allowing patients to monitor and adjust insulin levels based on real-time blood glucose data. This smart integration and user customization are enhancing the overall appeal of these devices.

In addition to these functional benefits, the market is being significantly boosted by technological innovations and the introduction of new products worldwide. A notable example is Medtronic’s MiniMed 670G system, which has made headlines as the world’s first hybrid closed-loop system, often referred to as an artificial pancreas. This advanced device automates insulin delivery based on data from the patient’s Continuous Glucose Monitor (CGM), thereby improving glycemic control and reducing the burden of manual adjustments.

The insulin pump market is also poised for strong growth due to global initiatives focused on diabetes management, led by governments and organizations like the International Diabetes Federation (IDF). These organizations are actively working to raise awareness about diabetes prevention and management through educational campaigns and collaborations with healthcare partners. Additionally, increasing healthcare funding and investments in diabetes care infrastructure are expected to support the widespread adoption of insulin pumps. Another key trend anticipated during the forecast period is the transition from traditional tethered pumps to patch pumps, which are gaining popularity due to their lightweight, compact design and user-friendly operation.

Insulin Pump Market Report Highlights

The tethered pumps segment held the leading market position in 2024 and is projected to maintain its dominance throughout the forecast period. These pumps deliver insulin through a thin tube connected to a cannula inserted under the skin, offering users reliable and consistent insulin infusion.

The MiniMed segment, driven by Medtronic’s innovative offerings, captured a 52.9% market share in 2024, supported by a high adoption rate and continuous advancements in insulin delivery technology.

The insulin set insertion devices segment accounted for a 41.4% share of the market in 2024, reflecting robust demand. This segment’s growth is fueled by the development of more ergonomic, user-friendly designs that prioritize comfort and ease of insertion for patients.

The hospital segment emerged as the largest end-user segment in 2024, commanding a market share exceeding 44.4%. Hospitals are increasingly embracing advanced technologies for diabetes management, including insulin pumps, in order to enhance patient outcomes, streamline insulin therapy, and reduce the risk of complications associated with diabetes.

Get a preview of the latest developments in the Insulin Pump Market? Download your FREE sample PDF copy today and explore key data and trends

Insulin Pump Market Segmentation

Grand View Research has segmented the global insulin pump market based on type, product, accessories, end-use and region:

Insulin Pump Type Outlook (Revenue, USD Million, 2018 - 2030)

Patch pumps

Tethered pumps

Insulin Pump Product Outlook (Revenue, USD Million, 2018 - 2030)

MiniMed

Accu-Chek

Tandem

Omnipod

My life omnipod

Others

Insulin Pump Accessories Outlook (Revenue, USD Million, 2018 - 2030)

Insulin reservoir or cartridges

Insulin set insertion devices

Battery

Insulin Pump End-use Outlook (Revenue, USD Million, 2018 - 2030)

Hospitals & clinics

Homecare

Laboratories

Insulin Pump Regional Outlook (Revenue, USD Million, 2018 - 2030)

North America

US

Canada

Europe

UK

Germany

France

Italy

Spain

Denmark

Sweden

Norway

Asia Pacific

Japan

China

India

Australia

Thailand

South Korea

Latin America

Brazil

Argentina

Mexico

Middle East & Africa

South Africa

Saudi Arabia

UAE

Kuwait

Key Players in the Insulin Pump Market

Medtronic

Hoffmann-La Roche AG

Tandem Diabetes Care, Inc.

Insulet Corporation

Ypsomed

Sanofi S.A.

Sooil development

Jiangsu Delfu Co., Ltd.

Cellnovo Ltd

Valeritas, Inc

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

0 notes

Text

Are Smart Implants the Future of Human Health 2025

Are Smart Implants the Future of Human Health 2025

In recent years, the idea of enhancing human health with smart technology has moved from science fiction into real-world innovation. Smart implants—tiny devices placed inside the human body to monitor or improve health—are gaining momentum in both research and clinical applications. In 2025, we stand at the frontier of a health revolution that could change the way we treat diseases, manage chronic conditions, and even prevent medical emergencies before they happen. In this blog, we'll explore what smart implants are, how they work, their benefits and risks, current technologies in 2025, and what the future might hold for this fascinating intersection of biology and technology. What Are Smart Implants? Smart implants are advanced medical devices implanted into the body to collect data, deliver therapies, or interact with biological systems in real time. Unlike traditional implants like hip replacements or pacemakers (which are mostly mechanical or single-purpose), smart implants use sensors, microprocessors, and wireless communication to perform multiple tasks. These devices can: - Monitor physiological signals (e.g., heart rate, glucose levels) - Send alerts or data to healthcare providers - Deliver drugs on-demand - Stimulate nerves or tissues electrically They are usually powered by miniature batteries or even harvest energy from body movement or heat. Key Technologies Driving Smart Implants in 2025 In 2025, several key technological advancements have accelerated the development and adoption of smart implants: 1. Miniaturization and Nanotechnology With nanotechnology, scientists can now design sensors and chips that are incredibly small yet highly functional. This allows implants to be more compact and less invasive. 2. Wireless Communication (5G and Beyond) The emergence of ultra-fast, low-latency communication protocols allows real-time data exchange between implants and healthcare systems, improving monitoring and response times. 3. AI Integration AI-enabled implants can analyze patterns in the body’s data and make intelligent decisions, such as adjusting a dose of insulin automatically or detecting early signs of infection. 4. Biocompatible Materials New materials that don’t trigger immune responses and can last longer in the body have made implants safer and more durable. 5. Energy Harvesting Techniques Some implants now generate their own energy from body heat, motion, or even biochemical reactions, eliminating the need for frequent battery replacements. Real-World Applications of Smart Implants Smart implants are already being used or tested in various medical areas: - Cardiology: Smart pacemakers monitor heart rhythms and adjust stimulation dynamically. Some also alert doctors if an arrhythmia is detected. - Diabetes Management: Continuous glucose monitors (CGMs) and insulin pumps are becoming smarter and more automated. In 2025, we now see closed-loop systems that manage insulin delivery with minimal human input. - Neurology: Brain implants are helping patients with Parkinson’s disease, epilepsy, or spinal cord injuries regain mobility or reduce symptoms. - Orthopedics: Smart knee or hip implants can monitor stress levels and wear, alerting doctors before a failure occurs. - Cancer Detection: Tiny biosensors are being designed to detect cancer biomarkers in real time, allowing for earlier diagnosis and intervention. Benefits of Smart Implants Smart implants offer a wide range of advantages: - Early detection of diseases through continuous monitoring - Personalized treatment, tailored in real-time - Less need for hospital visits, thanks to remote monitoring - Improved outcomes and longer device life due to predictive maintenance - Better quality of life for patients with chronic illnesses For example, a person with heart failure can receive a smart implant that monitors blood pressure and oxygen levels and warns both the patient and doctor before a crisis occurs. This could prevent hospitalization or even save lives.

Risks and Ethical Considerations While smart implants promise a lot, they are not without challenges: 1. Privacy and Security Health data transmitted from the body must be kept secure. Hacking or data leaks could have serious consequences. 2. Invasiveness Implanting devices into the body requires surgery, which carries risks of infection or rejection. 3. Cost and Accessibility These advanced devices may not be affordable for everyone, leading to potential inequalities in healthcare. 4. Data Ownership and Consent Who owns the data generated by an implant? How is it used, and who has access to it? 5. Long-Term Effects Many smart implants are still new, so their long-term impact on health and the immune system is still under research. The Future: A Connected Human Body? Looking ahead, it’s easy to imagine a future where the human body becomes a network of smart devices working together to optimize health. This vision is sometimes referred to as the "Internet of Bodies" (IoB), an extension of the Internet of Things (IoT), where interconnected implants, wearables, and external devices form an ecosystem that constantly communicates. In this scenario, your body might: - Communicate with your doctor 24/7 - Adjust your medications based on real-time stress or hormone levels - Alert emergency services if you’re injured or unconscious - Sync with AI assistants that guide you toward healthier habits This is not science fiction anymore. Several startups and research institutions are working to make this future a reality. Smart Implants and Personalized Medicine Perhaps one of the most exciting aspects of smart implants is their role in personalized medicine. By collecting individualized data, these devices allow doctors to treat patients based on their specific biological responses, rather than averages or generalized protocols. For example, instead of taking the same daily dose of medication, a smart implant might adjust your dosage throughout the day depending on how your body responds to stress, food intake, or activity levels. This level of personalization could improve effectiveness, reduce side effects, and offer patients a more responsive healthcare experience. Final Thoughts As of 2025, smart implants are not only feasible—they’re being used to change lives. These devices combine medicine, engineering, and artificial intelligence into one of the most promising frontiers of modern healthcare. While there are still hurdles to overcome, especially regarding ethics, cost, and long-term safety, the potential is undeniable. We may soon live in a world where our bodies work in partnership with intelligent implants to keep us healthier, longer, and more informed about our well-being than ever before. — For more insight into futuristic medical technology, explore this relevant Wikipedia article: https://en.wikipedia.org/wiki/Implant_(medicine) — You might also like these from our blog: - What If DNA Could Store All Human Knowledge 2025 https://edgythoughts.com/what-if-dna-could-store-all-human-knowledge-2025 - Can Quantum Sensors Revolutionize Brain Imaging 2025 https://edgythoughts.com/can-quantum-sensors-revolutionize-brain-imaging-2025 Read the full article

#20250101t0000000000000#2025httpsedgythoughtscomcanquantumsensorsrevolutionizebrainimaging2025#2025httpsedgythoughtscomwhatifdnacouldstoreallhumanknowledge2025#adoption#arrhythmia#articlehttpsenwikipediaorgwikiimplant#artificialcardiacpacemaker#artificialintelligence#biochemistry#biocompatibility#biologicalsystem#biology#biomarker#biosensor#bloodglucosemonitoring#bloodpressure#bloodsugarlevel#brainimplant#cancer#cancerbiomarker#cancerscreening#cardiacconductionsystem#cardiology#chroniccondition#communication#communicationprotocol#consentwho#continuousglucosemonitor#databreach#diabetes

0 notes

Text

Diabetes Drug Market: Industry Overview and Forecast 2024-2032

According to the latest findings, the Diabetes Drug Market was valued at USD 68.58 billion in 2023 and is projected to reach USD 113.02 billion by 2031, growing at a CAGR of 6.4% during the forecast period 2024-2031. This growth trajectory is driven by increasing global incidences of diabetes, rising awareness about diabetes management, and continuous innovation in pharmaceutical treatments.

Market Description

The diabetes drug market encompasses a wide range of medications designed to manage blood sugar levels in individuals with diabetes mellitus. The market has witnessed a notable surge due to lifestyle changes, increasing geriatric populations, and higher rates of obesity—key risk factors for type 2 diabetes. In addition, pharmaceutical companies are actively investing in research and development to launch next-generation insulin analogs, oral anti-diabetic drugs, and combination therapies that offer more efficient glycemic control with fewer side effects.

Get Free Sample Report @ https://www.snsinsider.com/sample-request/4177

Regional Analysis

North America continues to dominate the global market due to a well-established healthcare infrastructure, high disease prevalence, and early adoption of advanced therapeutics.

Europe holds a significant share, driven by supportive government initiatives and a growing diabetic population.

Asia-Pacific is anticipated to register the fastest growth rate during the forecast period, primarily due to urbanization, increasing healthcare expenditure, and rising awareness campaigns in countries like India and China.

Latin America and the Middle East & Africa are also seeing a steady uptick in demand, though limited access to advanced medications remains a challenge in certain areas.

Market Segmentation

By Drug Class:

Insulin

DPP-4 Inhibitors

GLP-1 Receptor Agonists

SGLT-2 Inhibitors

Others

By Type:

Type 1 Diabetes

Type 2 Diabetes

Gestational Diabetes

By Route of Administration:

Oral

Injectable

By Distribution Channel:

Hospital Pharmacies

Retail Pharmacies

Online Pharmacies

Key Players

Key Service Providers/Manufacturers

Novo Nordisk A/S (Ozempic, Rybelsus)

Eli Lilly and Company (Mounjaro, Trulicity)

Sanofi (Lantus, Toujeo)

Merck & Co., Inc. (Januvia, Janumet)

AstraZeneca (Farxiga, Bydureon)

Boehringer Ingelheim (Jardiance, Trajenta)

Bayer AG (Glucobay, Acarbose)

Takeda Pharmaceutical Company Limited (Actos, Nesina)

Pfizer Inc. (Exubera, Ertugliflozin)

MannKind Corporation (Afrezza, Technosphere Insulin)

Key Highlights

Rising prevalence of both type 1 and type 2 diabetes globally is significantly propelling market growth.

Technological advancements in insulin delivery devices are enhancing treatment adherence.

Oral anti-diabetic drugs are gaining traction due to convenience and reduced injection-related complications.

Strategic partnerships and acquisitions among key players are fueling innovation and expanding product pipelines.

Government initiatives and reimbursement policies are further supporting the market expansion.

Future Scope

The future of the diabetes drug market is expected to be shaped by precision medicine, personalized treatment plans, and biologics that target specific patient profiles. Artificial intelligence and machine learning will increasingly aid in early diagnosis and real-time glucose monitoring, thereby influencing prescription trends. Moreover, the emergence of smart insulin pens and closed-loop insulin delivery systems is likely to redefine disease management. As awareness and accessibility improve in emerging economies, the market is set for robust, long-term growth.

Conclusion

The diabetes drug market is witnessing dynamic growth driven by medical innovation, rising global health concerns, and a strong demand for improved therapeutic outcomes. As stakeholders across the value chain continue to collaborate on advancing patient care, the market is well-positioned to meet the growing healthcare needs of diabetic populations worldwide.

Contact Us: Jagney Dave - Vice President of Client Engagement Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

Other Related Reports:

Cell Viability Assay Market

Medical Power Supply Market

Post Traumatic Stress Disorder Treatment Market

MRI Guided Neurosurgical Ablation Market

#Diabetes Drug Market#Diabetes Drug Market Share#Diabetes Drug Market Size#Diabetes Drug Market Trends#Diabetes Drug Market Growth

0 notes